While Austin is a city brimming with opportunities, many families find simply affording our city a growing challenge, this is particularly true for families raising children. One critical provision preventing many of Austin’s low- and moderate-income families with children from sliding into poverty are tax returns bolstered by the refundable credits – the Earned Income Tax Credit and the Child Tax Credit. It can be a relatively substantial infusion of cash for families making ends meet with low or unpredictable incomes and may be the only opportunity a family has to purchase a vehicle, pay a large security deposit, or address a pressing repair.

Foundation Communities is a long-time partner of United Way for Greater Austin and has been a cornerstone of this family-sustaining work. In addition to ensuring hard-working families can access their full tax returns for free, they offer a service designed to be convenient, trustworthy, and available year-round.

“I’m grateful to all of our volunteers and community partners, including United Way, who make it possible for us to provide free, high-quality tax preparation services each year,” shared Kori Hattemer, Director of Financial Programs at Foundation Communities. “We couldn’t offer this vital community service without their time, commitment and energy. Our tax centers save hard-working families thousands in tax preparation fees and, this year, returned nearly $34 million in refunds to the local economy.”

More than 600 volunteers dedicated their time to assisting families, coming together to achieve an incredibly tangible impact. People relying on private tax preparation services would have paid an average of $270 for help with their taxes, and by avoiding these fees together all the families served together netted a savings of $5.3 million dollars. Thank you volunteers!

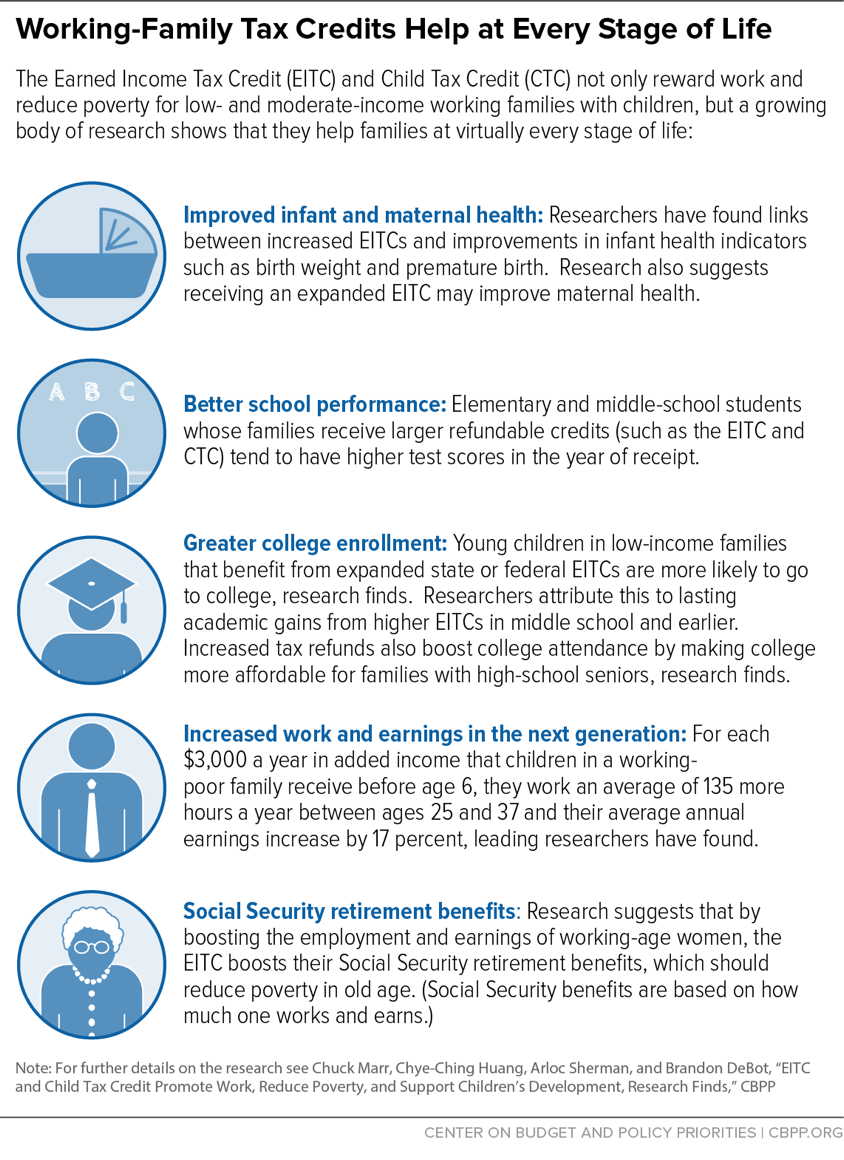

What’s more, the additional resources at this key time provides an unparalleled opportunity to make a difference in the lives of young children by raising a family’s overall income. According to the Center on Budget and Policy Priorities, “Research has found that lifting low-income families’ income when a child is young not only tends to improve a child’s immediate well-being, but is associated with better health, more schooling, more hours worked, and higher earnings in adulthood. A burgeoning literature links EITC receipt to improved school performance and higher college attendance rates.” In short, the EITC has demonstrated a powerful anti-poverty impact.

“We know that finances are deeply personal and have a big impact on families’ well-being, so we’re honored that over 19,000 central Texans trusted us to help them file their tax returns,” said Julian Huerta, Deputy Executive Director of Foundation Communities. “We look forward to continuing to connect those families with opportunities to improve their budgeting, pay off debt, and save for the future.”

Foundation Communities offers many services to the general community, including a suite of wrap-around services from health care to college application navigation.

Free tax preparation is an often unsung hero in the effort to make Austin a place for all to thrive, yielding a formidable return on investment and an even larger impact on families’ wellbeing.

[1] EITC funds represent approximately 1/3 of the funds returned to clients

[1] National Society of Accountants, http://connect.nsacct.org/blogs/nsa-blogger/2017/01/27/nsa-survey-reveals-fee-and-expense-data-for-tax-accounting-firms-in-2016-and-2017-projections

[1] http://www.cbpp.org/research/federal-tax/policy-basics-the-earned-income-tax-credit