Written by: Don Baylor

In our mind’s eye, we typically picture people struggling economically as individuals or families either disconnected from steady employment or those with jobs earning wages below the poverty level. What we too-often fail to consider is how much it truly takes to cover everyday expenses in our community and what might happen if income is interrupted.

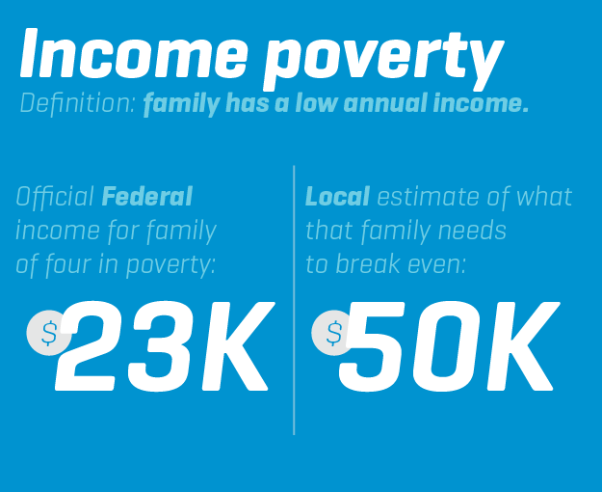

The federal poverty guidelines consider a family of four to be poor if the family income is $23,550 or less, but these numbers grossly underestimates the income necessary to meet a family’s basic needs. According to CPPP’s Better Texas Family Budgets, a Greater Austin family of four needs to earn more than $50,000 per year to cover housing, transportation, food, child care and other expenses. Notably, this “break-even” salary does not include any debt service or allow for any type of household savings. In order to save for a rainy day and college, the same Austin family needs to earn about $1,000 more in annual income.

While one in five Greater Austin families is officially income-poor as defined by the federal poverty level, a bigger share of Greater Austin families are living paycheck-to-paycheck and experience economic insecurity, with low incomes, insufficient savings, or both.

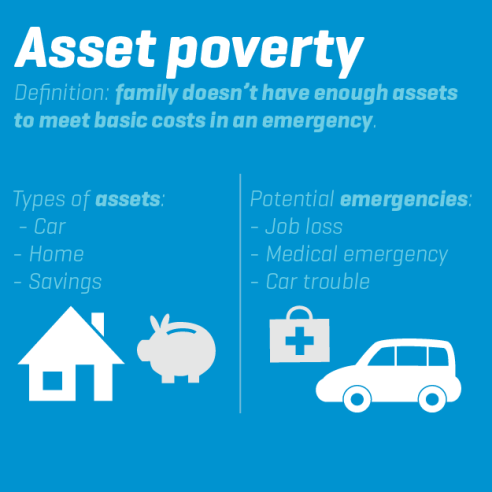

What’s more, income is only part of the story, because while income gets you by, assets get you ahead – and in our community nearly twice as many families are considered poor when we look at poverty through the lens of assets.

An individual or household in asset poverty is essentially a crisis away from financial hardship, having no assets to cushion a layoff or other financial emergency. If income is disrupted and the family is unable to live at the federal (income) poverty level for three months, the individual or household can be defined as asset poor. Like Austin, about one in six Texas households are income-poor, while about one in four households are asset poor, according to the CFED Assets & Opportunity Scorecard.

And the final piece of the puzzle is liquidity – how easy it might be for a family to turn assets into cash in times of need. Nearly half of all Texas households are living in “liquid asset poverty,” meaning they may have enough income and assets, but those assets—such as a home or car— are more difficult to turn into cash quickly. In the near future, we will have asset poverty numbers for the Austin area that will provide more insight into how many Central Texas households are one crisis away from falling into poverty.

In my professional life, I’ve worked consistently to advocate for policy that makes life better for struggling families. I’m proud to work with United Way for Greater Austin to help local employers provide access to on-site financial education, connect individuals to bank accounts and empower low-income families to save a portion of their tax refund through our Financial Opportunity program.

Join me in supporting United Way Greater Austin in our quest to see less asset poverty and more financial opportunity for Austin families!

Don Baylor is the Director of OpportunityTexas at the Center for Public Priorities, an expert on issues of poverty and income inequality, a member of the UWATX Board of Directors and a key Strategic Advisor for our Financial Opportunity program. For Poverty Awareness Month, we asked him to write about what’s missing in the discussion as we think about poverty.